-1661143487.jpg)

An early flurry of activity for GameStop's new NFT marketplace hasn't lasted.

In the days after GameStop (GME -3.80%) launched its long-hyped NFT marketplace last month, many media outlets reported that it got off to a surprisingly strong start.

Trading volume reached nearly $2 million on the first day, and the top 50 collections generated over $7.5 million of transactions in the first week.

These figures far exceeded cumulative transaction volumes on Coinbase's NFT platform, which launched several months earlier.

However, GameStop hasn't been able to sustain this initial surge of interest. Transaction volumes have plummeted over the past month, confirming that a pivot to NFTs is unlikely to save GameStop.

A sharp slowdown in activity

GameStop's NFT marketplace provides a real-time look at transaction volume on its statistics page.

The numbers point to a big drop in activity as the platform's novelty has worn off.

|

|

Over the past 30 days (as of Friday afternoon), the top 50 creators on GameStop's NFT marketplace had racked up cumulative transaction volumes of just over $10 million. (Creators outside the top 50 have a very small impact on the overall numbers.)

While exceeding $10 million in monthly transaction volume is a respectable result for a platform just getting off the ground, GameStop's cut is just 2.25%.

That translates to roughly $250,000 of revenue, or $3 million on an annualized basis. That's not enough to be profitable.

The bigger problem is that transaction volumes have slowed to barely more than $1 million across the top 50 creators for the past week -- less than $5 million per month.

GameStop needs its NFT marketplace to be building toward profitability; instead, it's slipping further from that target.

To be fair, GameStop plans to add more features and creators to its NFT platform over time, including Web3 gaming. That could help drive increased transaction volumes.

Yet even if GameStop were to grow transaction volumes tenfold compared to current levels (to around $50 million per month), the NFT marketplace would still be generating just $13.5 million of annual revenue.

That might be enough to cover overhead costs, but it certainly wouldn't make NFTs a significant profit engine for GameStop.

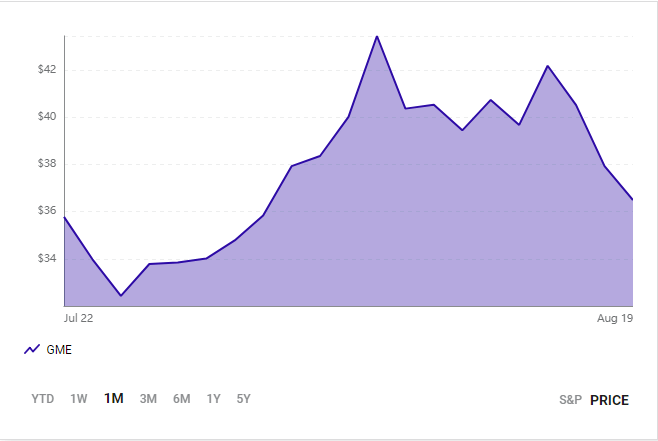

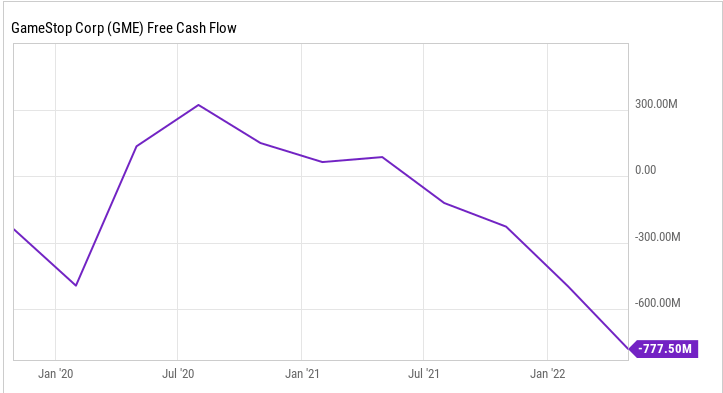

Indeed, GameStop posted a pre-tax loss of $395 million last year, and all signs point to an even bigger loss this year.

To highlight a few warning signs, GameStop's losses more than doubled year over year in the first quarter, gaming spending has plummeted in recent months, and GameStop fired its CFO in July.

Meanwhile, the company burned nearly $800 million during the 12 months ended in April, eroding its cash pile rapidly.

If the NFT marketplace is going to save GameStop, it will need to scale up extremely quickly to monthly transaction volumes in the $1 billion range (if not higher).

Source: The Motley Fool

One more distraction

In short, GameStop's core business is imploding. For now, the NFT marketplace is only aggravating the company's losses and cash burn.

GameStop may be able to fund cash burn by issuing even more shares, as demand from meme stock investors has kept its valuation at absurdly high levels relative to its fundamental prospects.

But in order to be self-funding before it burns through its last $1 billion, GameStop would need the NFT marketplace to become a huge cash cow within a year or two.

With transaction volumes sinking after the initial burst of interest, that doesn't seem likely at all.

Before you consider GameStop Corp., you'll want to hear this.

Our award-winning analyst team just revealed what they believe are the 10 best stocks for investors to buy right now... and GameStop Corp. wasn't one of them.

The online investing service they've run for two decades, Motley Fool Stock Advisor, has beaten the stock market by 3X.* And right now, they think there are 10 stocks that are better buys. - fool.com